Christmas could see unknowing workers hit with a tax bill of up to €2,828.59, in addition to any drop in income they may have suffered during the lockdown.

And January could see taxpayers, employers and Revenue scrambling to balance the tax affairs of the over 1 million recipients of the schemes.

This is according to Taxback.com, who say that the end of year tax bill, as a result of being on the Temporary Wage Subsidy Scheme (TWSS) or in receipt of COVID Pandemic Unemployment Payment (PUP), is likely to come as a “major shock” to thousands of people throughout the country at the end of the year.

The latest Taxback.com Taxpayer Sentiment Survey revealed that more than half (57%) of respondents receiving either payment are not aware that a future tax liability would be building.

Since its introduction in March, over 551,800 employees have been paid by the TWSS, while 517,600 have received the PUP.

Taxback.com say that while there can be no doubt that the implementation of these supports was absolutely necessary and has helped thousands of employers and employees alike, the processing of payments fell short in its execution, leaving those in receipt significantly out of pocket by the end of the year.

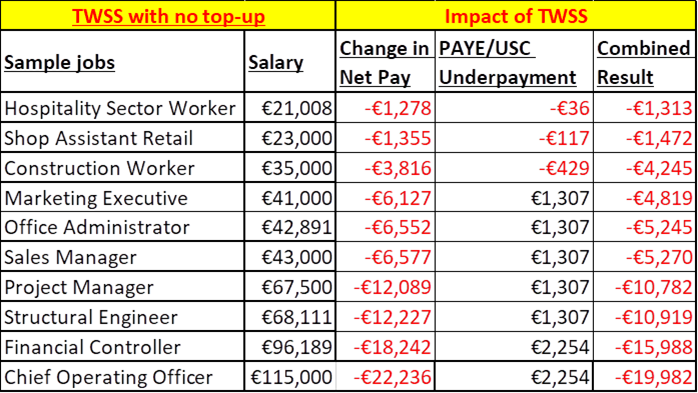

For those on TWSS, employees earning above €20,000 with no income top-up will see their net incomes drop during the 23 weeks by €1,000 up to €22,000 or more.

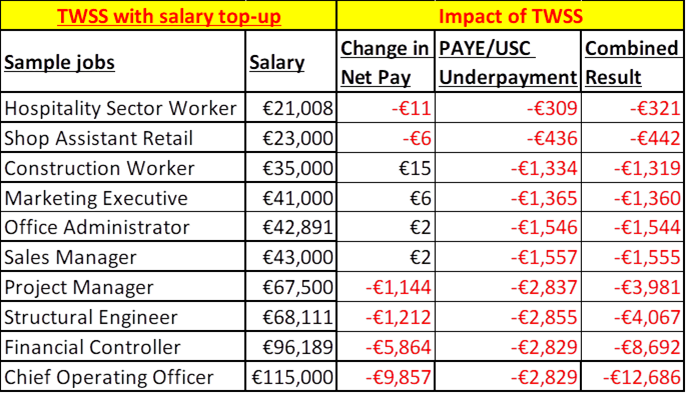

While employees with an income top-up from their employers won’t suffer a net income drop in 2020 unless their income is over €44,000 but will face a tax bill of between €300 and €2,829 at year end depending on their income.

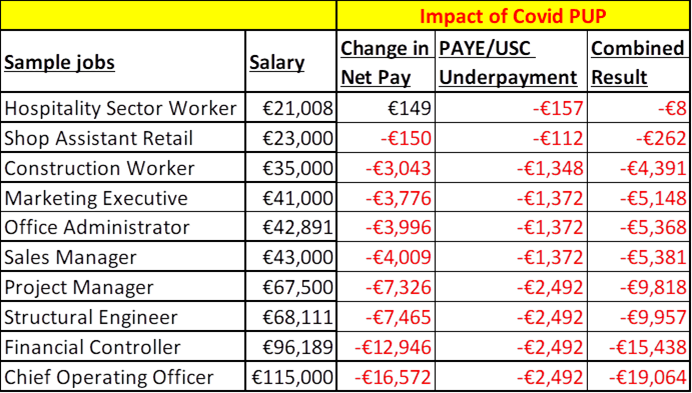

For those on PUP, workers that had been on incomes over €20,000 will generally suffer significant net income drops in 2020 and will also face tax bill of up to €2,494 at year end.

Examples of different wages and what the impacts are likely to be are outlined in the tables below.

Commenting on the findings, Marian Ryan, Consumer Tax Manager with Taxback.com, said: “When assessing the impact, we were mindful of the immediacy with which the Government had to roll out the scheme, so anomalies were to be expected.

“The issue, however, is that thousands of employees appear to be completely unaware of what is coming down the tracks.

“The scheme was rolled out in good faith to see employers through the instability of COVID-19 – and to ensure they emerge from the downturn – but a biproduct of its expediency could see less money in the pockets of employees in 2021 and possibly 2022 depending on how the tax burden is spread.”

SEE ALSO – Laois people spending more on clothes, takeaways and hardware as economy reopens